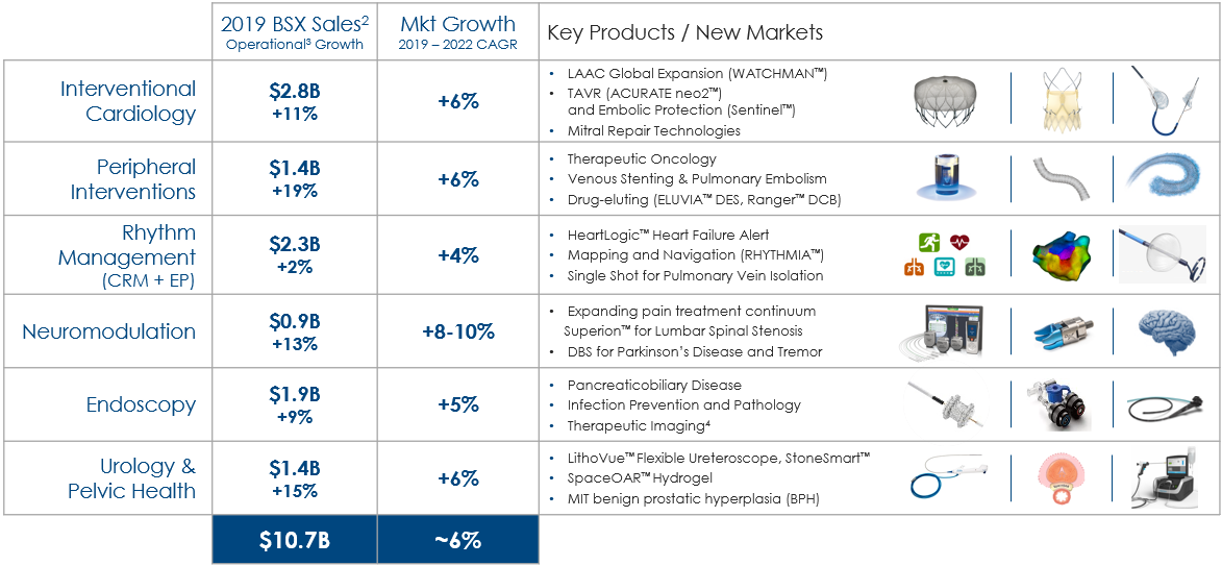

Boston Scientific is well positioned to continue to strengthen our performance and enhance our long-term growth profile. We’re investing to be a leader in large, high-growth markets with a differentiated product portfolio.

Large and Compelling High Growth Markets1

The outlook is strong across all of our businesses, driven by investment in key new launches and new markets where we have limited presence today, but unique pipeline technologies to drive future market penetration.

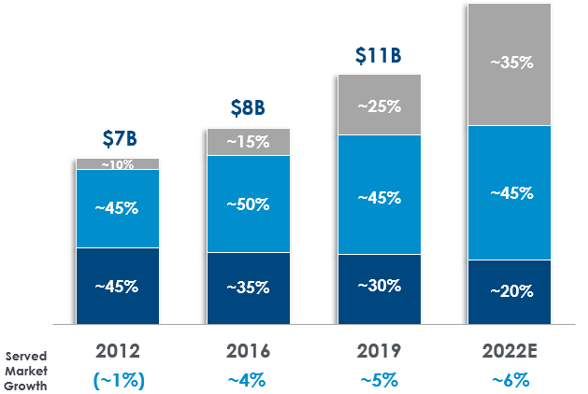

By focusing on these adjacent market opportunities, we anticipate increasing our revenue mix in high (≥8%) and moderate (3-7%) growth markets to 80 percent by 2022.

Increasing Our Revenue Mix in High and Moderate Growth Markets2

|

High growth market (≥8% CAGR):

IC (Structural Heart), RM (EP), PI (Drug Eluting, Venous, Therapeutic Oncology). NM, Endo (TIPs, Endoluminal Surgery), UroPH (Prostate Health)

Moderate growth markets (3-7% CAGR):

Endo (Core), Pl Core Arterial Core Oncology), UroPH (Core), IC (Complex PCH), RM (ICM)

Low growth market (<3% CAGR):

RM (Pacers. Defibrillators), IC (DES)

|

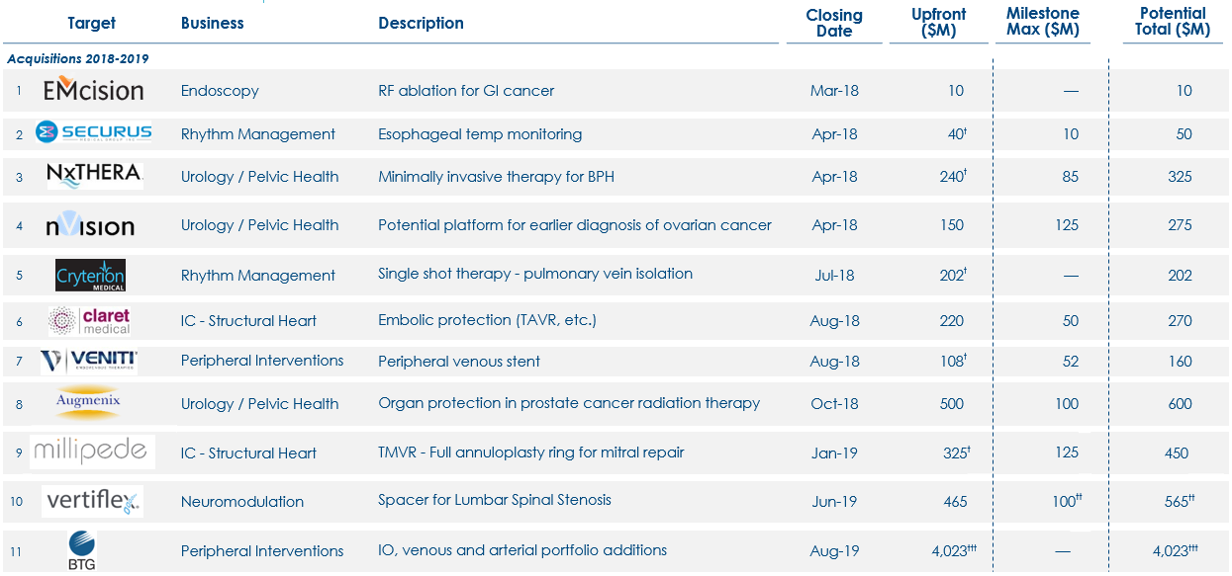

Successful Track Record of Business Development

Boston Scientific takes a disciplined and balanced approach to mergers and acquisitions, investing strategically in companies that complement our existing portfolio in order to continue to enhance category leadership and growth.

1 Unless noted otherwise, all references to market segments or sizes, share positions, and growth rates are BSX internal estimates and exclude the estimated impact of the COVID-19 pandemic.

2 Excludes Specialty Pharmaceuticals.

3 Non-GAAP measure; excludes certain GAAP items. For reconciliations of non-GAAP financial measures to the most directly comparable GAAP figures, please refer to our Financial Disclaimers and Non-GAAP Reconciliations.

4 Therapeutic Imaging excluded from Market/CAGR.

† Previously held equity investment; purchase price represents cash paid for remaining stake not already owned.

†† Contingent payments are based on a percentage of Vertiflex sales growth in the first three years following the acquisition close. We estimate the sales-based contingent payments to be in a range of zero to $100 million; however, the payments are uncapped over the three year term.

††† Represents purchase price of approximately £3.312 billion using an exchange rate of U.S. $1.21:£1.00 as of August 19, 2019.

All trademarks are the property of their respective owners.